The basic premise of the Equitable Distribution law is that marriage is an economic partnership. Upon the dissolution of that partnership, the assets and liabilities that were

The basic premise of the Equitable Distribution law is that marriage is an economic partnership. Upon the dissolution of that partnership, the assets and liabilities that were

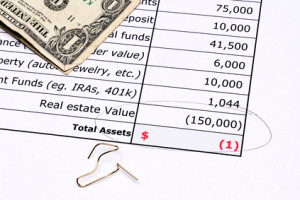

accumulated during the marriage are divided between you and your spouse.

Marital property includes all assets or liabilities that were acquired between the date of your marriage and the date of the filing of a divorce action or the execution of a separation or marital settlement agreement.

Separate property generally is all property acquired before your marriage or after the execution of a Separation Agreement or the commencement of a divorce action. It also includes gifts that you received during the marriage, property that you received through an inheritance or money you received as compensation for personal injuries.

Assets include personal property such as bank accounts, cars, household furnishings, pensions, and retirement accounts; real property such as houses, camps, or land; and intangible property such as an interest in a business or a professional practice.

Liabilities include credit cards, bank loans, taxes and any other debt incurred during the marriage, regardless of whose name it is in, or which spouse incurred the debt.

The Equitable Distribution Law does not require marital property to be distributed equally. Rather, it allows a court to divide such property “equitably”. While such property is often divided equally, and many couples agree to do so, the Equitable Distribution Law has 15 factors that are to be used by a court in determining how this property is divided upon a separation or divorce.

often divided equally, and many couples agree to do so, the Equitable Distribution Law has 15 factors that are to be used by a court in determining how this property is divided upon a separation or divorce.

So, what does this mean? In short, if it would not be “fair” to divide the marital assets equally upon a divorce, they can be divided in a way that you feel is “equitable” after applying one or more of these factors.

Finally, if one spouse used separate property, such as funds earned before the marriage, a gift from a parent or relative, or funds received from an inheritance or a personal injury award, toward the purchase of an asset, that spouse can be reimbursed for the separate property they used toward the purchase of that marital asset.

Share with Friends:

Need More Information?

To schedule a free phone or video consultation, complete and submit the form below, email us at [email protected], or call 518-529-5900.